#most secure cryptocurrency

Explore tagged Tumblr posts

Text

BitBharat's IEO Launchpad is the perfect platform for your next investment!

BitBharat, the leading digital asset exchange in India, is pleased to offer Initial Exchange Offering (IEO) Launchpad. The Launchpad will provide a platform for innovative projects to raise funds and connect with BitBharat's large and active user base. The IEO Launchpad is a great opportunity for projects that are looking to raise funds and gain exposure in the booming digital asset space. BitBharat has a large and active user base, and the Launchpad will provide a great platform for projects to connect with potential investors and users.

#cryptocurrency exchange#top crypto exchanges#buy crypto currency#most secure crypto exchange#crypto exchange list

0 notes

Text

It's hard to explain to people from other cultures that our malls are largely useless. In most of Asia, for instance, the mall scene is still vibrant. Stores are in business, generating massive revenue, and attracting daily shoppers, who buy exotic foreign goods like "clothes" and "food."

Here, though, malls have rotted from some kind of unknowable internal malaise until they collapsed in on themselves and took half the economy with them. This unexpected failure has terrified capitalists, who have fled the retail sector in much the same way that folks of old used to cross the street to avoid those with facial deformities. Can't take a chance that it's contagious. Have to think of my family, who happen to all be badly spelled cryptocurrency scams and presale condo flips.

In my town, there's one large mall that's still successful. The demise of all competition has served to make it stronger, like in the movie Highlander where the main guy figures out that he can perform a leveraged buyout of Bluestar Airlines. Every Christmas, this lucky survivor of promenade warfare is thronged with the entire city's worth of shoppers, demanding to be let inside to a warm space where they can walk between stores to do their stuff-gaining. In other words, it is a ripe place for me to enjoy the heated underground parking garage in which to fix my car.

Sure, if you ask the security guards, "I'm not allowed to" change my oil while the moneyed elite are fritting to and fro. They're pretty busy at Christmas, though, and they certainly won't get upset at a guy with a Sak's bag sitting on his trunk, even if that bag is full of dirt-filled 15w40 and smelling faintly of coolant. They just can't take the chance that kicking me out is what killed the other malls.

419 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

272 notes

·

View notes

Text

So NFTgate has now hit tumblr - I made a thread about it on my twitter, but I'll talk a bit more about it here as well in slightly more detail. It'll be a long one, sorry! Using my degree for something here. This is not intended to sway you in one way or the other - merely to inform so you can make your own decision and so that you aware of this because it will happen again, with many other artists you know.

Let's start at the basics: NFT stands for 'non fungible token', which you should read as 'passcode you can't replicate'. These codes are stored in blocks in what is essentially a huge ledger of records, all chained together - a blockchain. Blockchain is encoded in such a way that you can't edit one block without editing the whole chain, meaning that when the data is validated it comes back 'negative' if it has been tampered with. This makes it a really, really safe method of storing data, and managing access to said data. For example, verifying that a bank account belongs to the person that says that is their bank account.

For most people, the association with NFT's is bitcoin and Bored Ape, and that's honestly fair. The way that used to work - and why it was such a scam - is that you essentially purchased a receipt that said you owned digital space - not the digital space itself. That receipt was the NFT. So, in reality, you did not own any goods, that receipt had no legal grounds, and its value was completely made up and not based on anything. On top of that, these NFTs were purchased almost exclusively with cryptocurrency which at the time used a verifiation method called proof of work, which is terrible for the environment because it requires insane amounts of electricity and computing power to verify. The carbon footprint for NFTs and coins at this time was absolutely insane.

In short, Bored Apes were just a huge tech fad with the intention to make a huge profit regardless of the cost, which resulted in the large market crash late last year. NFTs in this form are without value.

However, NFTs are just tech by itself more than they are some company that uses them. NFTs do have real-life, useful applications, particularly in data storage and verification. Research is being done to see if we can use blockchain to safely store patient data, or use it for bank wire transfers of extremely large amounts. That's cool stuff!

So what exactly is Käärijä doing? Kä is not selling NFTs in the traditional way you might have become familiar with. In this use-case, the NFT is in essence a software key that gives you access to a digital space. For the raffle, the NFT was basically your ticket number. This is a very secure way of doing so, assuring individuality, but also that no one can replicate that code and win through a false method. You are paying for a legimate product - the NFT is your access to that product.

What about the environmental impact in this case? We've thankfully made leaps and bounds in advancing the tech to reduce the carbon footprint as well as general mitigations to avoid expanding it over time. One big thing is shifting from proof of work verification to proof of space or proof of stake verifications, both of which require much less power in order to work. It seems that Kollekt is partnered with Polygon, a company that offers blockchain technology with the intention to become climate positive as soon as possible. Numbers on their site are very promising, they appear to be using proof of stake verification, and all-around appear more interested in the tech than the profits it could offer.

But most importantly: Kollekt does not allow for purchases made with cryptocurrency, and that is the real pisser from an environmental perspective. Cryptocurrency purchases require the most active verification across systems in order to go through - this is what bitcoin mining is, essentially. The fact that this website does not use it means good things in terms of carbon footprint.

But why not use something like Patreon? I can't tell you. My guess is that Patreon is a monthly recurring service and they wanted something one-time. Kollekt is based in Helsinki, and word is that Mikke (who is running this) is friends with folks on the team. These are all contributing factors, I would assume, but that's entirely an assumption and you can't take for fact.

Is this a good thing/bad thing? That I also can't tell you - you have to decide that for yourself. It's not a scam, it's not crypto, just a service that sits on the blockchain. But it does have higher carbon output than a lot of other services do, and its exact nature is not publicly disclosed. This isn't intended to sway you to say one or the other, but merely to give you the proper understanding of what NFTs are as a whole and what they are in this particular case so you can make that decision for yourself.

95 notes

·

View notes

Text

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

273 notes

·

View notes

Text

Emma Mae Weber at MMFA:

Right-wing media attacked Minnesota Gov. Tim Walz, the Democratic nominee for vice president, for not owning stocks, bonds, or real estate. While some have celebrated Walz’s portfolio, or lack thereof, some right-wing media figures have drawn absurd conclusions about Walz’s ability to understand the economy or his support of capitalism because of his economic standing.

According to recent financial disclosures, Democratic vice presidential candidate Tim Walz doesn’t own stocks or securities. He also does not currently own any real estate. Walz and his wife Gwen Walz sold their most recent home and moved into the governor’s mansion in 2019 when Walz became the governor of Minnesota. Per the disclosures, the only investments Walz holds are his retirement, pension, and life insurance accounts. [The Hill, 8/7/24; The New York Times, 8/9/24]

It’s rare for elected officials not to hold financial assets, and some people are celebrating the modesty of Walz’s portfolio. Walz and his wife also reported no mutual funds, bonds, private equities, book deals, speaking fees, cryptocurrency, or racehorse interests. [Axios, 8/7/24; The Wall Street Journal, 8/12/24]

Most Americans don’t own stocks, bonds, or cryptocurrency. A Federal Reserve report on Americans’ economic well-being shows that just 31% of non-retirees in America own “Stocks, bonds, ETFs, or mutual funds held outside a retirement account.” The number only goes up to 35% for all adult Americans. The report also shows that 64% of Americans in 2023 owned a home, and that just 7% of Americans held or used cryptocurrency in 2023. [Federal Reserve, Economic Well-Being of U.S. Households in 2023, 5/24]

As a member of Congress in 2011, Walz co-sponsored the STOCK Act in an attempt to combat insider trading. Signed into law in 2012 by then-President Barack Obama, the STOCK Act aimed to prevent lawmakers and congressional staffers from trading on non-public information. While pushing for the legislation, Walz spoke about the importance of “restoring faith” among Americans that their lawmakers are not in office only to enrich themselves. [USA Today, 8/9/24; Twitter/X, 8/7/24]

What will the right-wing media whine about this time in regards to Tim Walz? Having a financial portfolio of an average American, and one that doesn’t have any stock market or bond investments.

39 notes

·

View notes

Text

Maurizio Cattelan Comedian

Banana and duct tape. Executed in 2019, this work is number 2 from an edition of 3 plus 2 artist’s proofs.

Duct-Taped Banana Artwork Sells for $6.2M

Maurizio Cattelan's provocative artwork of a banana duct-taped to a wall has fetched $6.2m (£4.9m) at Sotheby's in New York - four times higher than pre-sale estimates.

The auction house says Chinese cryptocurrency entrepreneur Justin Sun outbid six other rivals to get the "Comedian" installation of the Italian visual artist on Wednesday.

"In the coming days, I will personally eat the banana as part of this unique artistic experience," Mr Sun was quoted as saying.

The taped banana - now perhaps one of the most expensive fruits ever sold - was actually bought earlier in the day for a mere $0.35, according to the New York Times.

"Comedian" was first unveiled to the public in 2019, instantly becoming a viral sensation and also provoking heated debates about what art is.

The installation - which has travelled around the world - comes with instructions on how to replace the banana whenever it rots.

In fact, the fruit has been eaten not once, but twice.

In 2023, a South Korean art student helped himself when the installation went on display at Seoul's Leeum Museum of Art.

The museum later placed a new banana in the same spot, local media reported.

Four years earlier, a performance artist pulled the banana from the wall after the artwork was sold for $120,000 at Art Basel in Miami.

The banana was swiftly replaced, and no further action was taken.

Justin Sun runs the Tron blockchain network, which facilitates some cryptocurrency transactions. Last year the US Securities and Exchange Commission accused him of fraud, saying he had falsely inflated trading volumes of TRX, Tron’s crypto token. Mr Sun denies the charges.

By Jaroslav Lukiv.

#Maurizio Cattelan#Maurizio Cattelan Comedian 2019#italian artist#visual artist#banana#Duct-Taped Banana Artwork Sells for $6.2M#banana duct-taped to a wall#Justin Sun#art#artist#art work#art world#art news

21 notes

·

View notes

Text

Fuck Chromium (and that includes Brave and Vivialdi)

I have made multiple posts about why you should use Firefox, and of course I get the reply "not all chromium browsers are bad, they are not all as evil as Chrome." And sure, browsers who use the chromium code are not required to do all the shady things that Google does with it.

Still, I think it's bad that chromium-based browsers are getting close to total market dominance. By this point it has made Google's competitors like Microsoft and Opera drop their own unique proprietary browser engines for chromium. Browsers are becoming a fucking monoculture at this point. And Chromium becoming the browser code base of choice empowers Google, since they are the ones who mainly develop, maintain and fund its code. It means supporting them in their quest to become an internet monopoly that can do things like drm the web itself.

So let me be clear: you are still supporting google by using chromium-based browsers. By helping out in making chromium the de facto standard for browsers, you are giving google power. They are the ones driving chromium development, they will set the standards. And those standards will be in Google's favor. They are an ad company, their goal is to kill off adblockers by making them impossible to use, first with manifest v3 for extensions and now WEI, their web drm.

Brave is a joke.

The supposed "good guy" chromium browsers people recommend are actually shady as shit.

The one i see recommended the most is Brave, and it's fucking terrible. For one thing, it is funded by right-wing techbro Brendan Eich. He was Mozilla CEO for some time, but then people found he was a massive homophobe who funded campaigns against marriage equality, and Mozilla forced him to resign. And that's why he created Brave. That's who you are supporting by using Brave.

It runs off chromium because that's the easy and lazy choice for a browser. And it's literally funded through cryptocurrency, probably the negative environmental impact is a plus in Eich's book. And its adblocker runs off the same dishonest business model as adblock plus does, it will not block ads if advertisers pay them for the privilege. This betrayal of the users is opt-in at least, and you get paid for watching ads, but it's in the aforementioned worthless crypto beans. Brave is a joke.

Vivaldi and the importance of open-source

And then there's Vivaldi, it's a freeware proprietary browser run by a for-profit company, which alone should scare you off it.

"If you aren't paying for it, you are not the customer, you are the product" is a phrase that sometimes unfairly gets applied to open source projects to dismiss them. If it's open source and either community-run or run by a non-profit foundation like the Open document foundation for Libreoffice and or the Mozilla foundation for Firefox/Thunderbird, you are safe even if it's free.

But that phrase 100% applies to free products from for-profit corporations. These companies need to make profits at some point for for their shareholders, and if it is not from selling goods or services, it comes from things like selling your user's data or "attention".

That applies to Vivaldi, who makes big promises about how they will respect their users privacy and never sell their data. But promises mean nothing, Google also says they respect your privacy. And the thing is, Vivaldi is closed source. Not entirely, ironically the bits they got from Google's chromium are open source, but other parts of their code is closed-source. And what that means is, they can make any and all promises about what their browser's code does and there is nobody except Vivaldi that can check if their code actually fulfils those promises. Only Vivaldi has access to that code.

I'm no open-source fanatic, like I don't care if some random game i install and play is closed-source, as long as it is from a credible developer. But open-source is important for security and privacy, because that means someone else other than the company who develops the program can vet it's code for vulnerabilities and privacy violations. Your browser and e-mail client (vivaldi has an e-mail client too) should be open-source for your own safety, because those programs handle sensitive data like your passwords or your e-mails. Closed-source is not more secure, since Kerckhoff's principle applies to digital security and privacy.

And Vivaldi by being proprietary software fails that test. Their own justification is that being closed-source is "their first line of defense, to prevent other parties from taking the code and building an equivalent browser (essentially a fork) too easily." It's the same hypocritical argument that Red Hat used to justify making their Enterprise Linux distro closed-source. "It's fine if we use chromium's code to build our own browser, and expressly for making an Opera clone (that's the literal point of Vivaldi, that's why the name is a music reference), but if someone does the same with our product, they're evil." It's nauseating and alone justification to distrust Vivaldi as it is crying out to be trusted.

Listen to some Antonio Vivaldi instead, his music slaps. And install Firefox and Thunderbird instead.

110 notes

·

View notes

Text

Two years ago when “Michael,” an owner of cryptocurrency, contacted Joe Grand to help recover access to about $2 million worth of bitcoin he stored in encrypted format on his computer, Grand turned him down.

Michael, who is based in Europe and asked to remain anonymous, stored the cryptocurrency in a password-protected digital wallet. He generated a password using the RoboForm password manager and stored that password in a file encrypted with a tool called TrueCrypt. At some point, that file got corrupted and Michael lost access to the 20-character password he had generated to secure his 43.6 BTC (worth a total of about €4,000, or $5,300, in 2013). Michael used the RoboForm password manager to generate the password but did not store it in his manager. He worried that someone would hack his computer and obtain the password.

“At [that] time, I was really paranoid with my security,” he laughs.

Grand is a famed hardware hacker who in 2022 helped another crypto wallet owner recover access to $2 million in cryptocurrency he thought he’d lost forever after forgetting the PIN to his Trezor wallet. Since then, dozens of people have contacted Grand to help them recover their treasure. But Grand, known by the hacker handle “Kingpin,” turns down most of them, for various reasons.

Grand is an electrical engineer who began hacking computing hardware at age 10 and in 2008 cohosted the Discovery Channel’s Prototype This show. He now consults with companies that build complex digital systems to help them understand how hardware hackers like him might subvert their systems. He cracked the Trezor wallet in 2022 using complex hardware techniques that forced the USB-style wallet to reveal its password.

But Michael stored his cryptocurrency in a software-based wallet, which meant none of Grand’s hardware skills were relevant this time. He considered brute-forcing Michael’s password—writing a script to automatically guess millions of possible passwords to find the correct one—but determined this wasn’t feasible. He briefly considered that the RoboForm password manager Michael used to generate his password might have a flaw in the way it generated passwords, which would allow him to guess the password more easily. Grand, however, doubted such a flaw existed.

Michael contacted multiple people who specialize in cracking cryptography; they all told him “there’s no chance” of retrieving his money. But last June he approached Grand again, hoping to convince him to help, and this time Grand agreed to give it a try, working with a friend named Bruno in Germany who also hacks digital wallets.

Grand and Bruno spent months reverse engineering the version of the RoboForm program that they thought Michael had used in 2013 and found that the pseudo-random number generator used to generate passwords in that version—and subsequent versions until 2015—did indeed have a significant flaw that made the random number generator not so random. The RoboForm program unwisely tied the random passwords it generated to the date and time on the user’s computer—it determined the computer’s date and time, and then generated passwords that were predictable. If you knew the date and time and other parameters, you could compute any password that would have been generated on a certain date and time in the past.

If Michael knew the day or general time frame in 2013 when he generated it, as well as the parameters he used to generate the password (for example, the number of characters in the password, including lower- and upper-case letters, figures, and special characters), this would narrow the possible password guesses to a manageable number. Then they could hijack the RoboForm function responsible for checking the date and time on a computer and get it to travel back in time, believing the current date was a day in the 2013 time frame when Michael generated his password. RoboForm would then spit out the same passwords it generated on the days in 2013.

There was one problem: Michael couldn’t remember when he created the password.

According to the log on his software wallet, Michael moved bitcoin into his wallet for the first time on April 14, 2013. But he couldn’t remember if he generated the password the same day or some time before or after this. So, looking at the parameters of other passwords he generated using RoboForm, Grand and Bruno configured RoboForm to generate 20-character passwords with upper- and lower-case letters, numbers, and eight special characters from March 1 to April 20, 2013.

It failed to generate the right password. So Grand and Bruno lengthened the time frame from April 20 to June 1, 2013, using the same parameters. Still no luck.

Michael says they kept coming back to him, asking if he was sure about the parameters he’d used. He stuck to his first answer.

“They really annoyed me, because who knows what I did 10 years ago,” he recalls. He found other passwords he generated with RoboForm in 2013, and two of them did not use special characters, so Grand and Bruno adjusted. Last November, they reached out to Michael to set up a meeting in person. “I thought, ‘Oh my God, they will ask me again for the settings.”

Instead, they revealed that they had finally found the correct password—no special characters. It was generated on May 15, 2013, at 4:10:40 pm GMT.

“We ultimately got lucky that our parameters and time range was right. If either of those were wrong, we would have … continued to take guesses/shots in the dark,” Grand says in an email to WIRED. “It would have taken significantly longer to precompute all the possible passwords.”

Grand and Bruno created a video to explain the technical details more thoroughly.

RoboForm, made by US-based Siber Systems, was one of the first password managers on the market, and currently has more than 6 million users worldwide, according to a company report. In 2015, Siber seemed to fix the RoboForm password manager. In a cursory glance, Grand and Bruno couldn’t find any sign that the pseudo-random number generator in the 2015 version used the computer’s time, which makes them think they removed it to fix the flaw, though Grand says they would need to examine it more thoroughly to be certain.

Siber Systems confirmed to WIRED that it did fix the issue with version 7.9.14 of RoboForm, released June 10, 2015, but a spokesperson wouldn’t answer questions about how it did so. In a changelog on the company’s website, it mentions only that Siber programmers made changes to “increase randomness of generated passwords,” but it doesn’t say how they did this. Siber spokesman Simon Davis says that “RoboForm 7 was discontinued in 2017.”

Grand says that, without knowing how Siber fixed the issue, attackers may still be able to regenerate passwords generated by versions of RoboForm released before the fix in 2015. He’s also not sure if current versions contain the problem.

“I'm still not sure I would trust it without knowing how they actually improved the password generation in more recent versions,” he says. “I'm not sure if RoboForm knew how bad this particular weakness was.”

Customers may also still be using passwords that were generated with the early versions of the program before the fix. It doesn’t appear that Siber ever notified customers when it released the fixed version 7.9.14 in 2015 that they should generate new passwords for critical accounts or data. The company didn’t respond to a question about this.

If Siber didn’t inform customers, this would mean that anyone like Michael who used RoboForm to generate passwords prior to 2015—and are still using those passwords—may have vulnerable passwords that hackers can regenerate.

“We know that most people don't change passwords unless they're prompted to do so,” Grand says. “Out of 935 passwords in my password manager (not RoboForm), 220 of them are from 2015 and earlier, and most of them are [for] sites I still use.”

Depending on what the company did to fix the issue in 2015, newer passwords may also be vulnerable.

Last November, Grand and Bruno deducted a percentage of bitcoins from Michael’s account for the work they did, then gave him the password to access the rest. The bitcoin was worth $38,000 per coin at the time. Michael waited until it rose to $62,000 per coin and sold some of it. He now has 30 BTC, now worth $3 million, and is waiting for the value to rise to $100,000 per coin.

Michael says he was lucky that he lost the password years ago because, otherwise, he would have sold off the bitcoin when it was worth $40,000 a coin and missed out on a greater fortune.

“That I lost the password was financially a good thing.”

23 notes

·

View notes

Text

About Exnori

Hello, I am Exnori.com, a premier cryptocurrency exchange dedicated to revolutionizing the way you trade digital assets. I am here to offer a secure, efficient, and user-friendly platform that caters to both beginners and seasoned traders alike. Let me take you through the various aspects of my services and why I am the go-to choice for cryptocurrency trading.

Mission and Vision

At my core, my mission is to create a transparent, secure, and seamless trading environment. I strive to empower my users with the tools and knowledge they need to navigate the volatile world of cryptocurrencies confidently. My vision is to become a cornerstone of the cryptocurrency ecosystem, where traders can thrive and reach their financial goals.

Robust Security Protocols

Security is my utmost priority. I employ state-of-the-art encryption techniques, robust multi-factor authentication, and continuous monitoring to protect your assets and personal information. My security infrastructure is designed to be resilient against cyber threats, ensuring that your investments are safe with me.

User-Centric Design

I am designed with the user in mind. My platform boasts a clean, intuitive interface that simplifies the trading process. Whether you are accessing me via desktop or mobile, you will find a consistent and user-friendly experience that makes trading easy and accessible, no matter where you are.

Extensive Cryptocurrency Selection

I offer a vast selection of cryptocurrencies for trading. From established giants like Bitcoin, Ethereum, and Ripple to promising new altcoins, my diverse range of assets ensures that you can find the right opportunities to diversify your portfolio and maximize your trading potential.

Competitive and Transparent Fee Structure

I believe in providing value to my users. My fee structure is transparent and competitive, allowing you to understand exactly what you are paying for each transaction. By keeping fees low, I help you maximize your returns and make the most out of your trading activities.

Comprehensive Educational Resources

Knowledge is power, especially in the dynamic world of cryptocurrency. I offer a wealth of educational resources, including in-depth articles, video tutorials, and live webinars. These resources are tailored to help you understand market trends, develop effective trading strategies, and make informed decisions.

Advanced Trading Tools

For the more experienced traders, I provide a suite of advanced trading tools. These include detailed charting capabilities, technical indicators, and algorithmic trading support through my API. Whether you are a day trader or a long-term investor, my tools are designed to enhance your trading strategy and performance.

Community and Customer Support

I pride myself on fostering a vibrant community of traders. My platform encourages interaction and the exchange of ideas among users, creating a collaborative environment. Additionally, my customer support team is available 24/7 to assist you with any issues or questions you may have, ensuring a smooth and supportive trading experience.

Innovation and Continuous Improvement

The cryptocurrency market is constantly evolving, and so am I. I am committed to continuous innovation and regularly update my platform with new features and improvements. This dedication to staying ahead of the curve ensures that I can provide you with the best tools and technologies for successful trading.

Conclusion

Choosing Exnori.com means partnering with a platform that is dedicated to your success. With my robust security measures, user-centric design, extensive asset selection, competitive fees, and unwavering support, I am here to help you achieve your trading goals. Join me at Exnori.com and experience the future of cryptocurrency trading.

By joining Exnori.com, you are becoming part of a dynamic and forward-thinking community. Let's trade smarter, safer, and more effectively together. Welcome to Exnori.com, where your trading journey begins!

13 notes

·

View notes

Text

Unveiling “The Beltway Brawl”: A Political NFT Collection with Purpose

In an era where the digital and political landscapes are increasingly intertwined, a groundbreaking NFT project dubbed “The Beltway Brawl” is set to capture the essence of a pivotal moment in American politics. This isn’t just another digital collectible; it’s a dynamic slice of history, immortalizing the extraordinary showdown between Donald Trump, who faces 91 criminal counts, and Joe Biden, the oldest sitting president in U.S. history. At its core, this NFT collection is a vivid encapsulation of democracy’s trials, the intricacies of leadership, and the relentless march of time.

A Snapshot of Our Era

“The Beltway Brawl” does more than just chronicle a historical event; it represents the resilience of democracy amidst one of the most challenging periods in modern American politics. The collection features imagery and themes that reflect the high stakes and intense rivalry of the upcoming election, encapsulating the emotions and significance of this unprecedented battle for the nation’s future.

More Than a Keepsake

Owning a piece of “The Beltway Brawl” collection means more than just holding on to a digital souvenir. It signifies an active participation in the political process, a way to directly engage with the heartbeat of democracy. Upon minting, collectors can choose their allegiance — Republican or Democratic — thereby influencing where a portion of the profits will be directed. Specifically, 5% of the initial collection profits are earmarked to support initiatives and organizations closely aligned with the major issues championed by the political affiliation that receives the majority support from NFT holders, blending the worlds of cryptocurrency, art, and politics in an innovative show of support.

Join the Race, Make Your Voice Heard

The stakes are high, not just on the political stage but also within the “The Beltway Brawl” community. The project offers an exciting incentive: a race for 5 ETH in rewards if the collection sells out within the first 48 hours. This adds a layer of engagement and competition, mirroring the competitive nature of the political arena it represents. It’s a call to action for supporters of both political spectrums to rally, secure their piece of this momentous occasion, and let their political stances resonate within the digital sphere.

A Pivotal Moment in History

As we stand on the precipice of what could be one of the most talked-about elections in recent history, “The Beltway Brawl” offers a unique opportunity to be part of a moment that will be dissected and discussed for generations. This NFT collection is not just a passive investment but a statement, a way to align with a cause, and a testament to the power of collective action in shaping the future.

Stay Tuned

“The Beltway Brawl” is poised to be a significant milestone in the intersection of politics, art, and technology. As we gear up for its release, the anticipation builds for what promises to be a defining symbol of our times. Keep an eye on the horizon for more details on how you can secure your piece of political history and take a stand in the most innovative way possible.

In essence, “The Beltway Brawl” transcends the traditional boundaries of NFTs, offering not just a collectible, but a chance to be part of a larger movement. It’s a testament to the power of digital innovation in amplifying political engagement and a reminder of the pivotal role each person plays in the unfolding story of democracy.

14 notes

·

View notes

Text

Buy, trade, and hold cryptocurrencies on BitBharat #Exchange Platform

BitBharat, an India-based cryptocurrency exchange, has announced the launch of its Initial Exchange Offering (IEO) launchpad. The launchpad will allow users to buy and sell tokens that are listed on the platform.

#buy crypto currency#cryptocurrency exchange#top crypto exchanges#best crypto exchange#best crypto#trading app top 10#crypto exchanges#crypto exchange list cryptocurrency trading app#most secure crypto exchange#crypto trading platform cryptocurrency#exchange platform#top cryptocurrency exchange

0 notes

Text

How Bitcoin Transformed My Life: A Journey of Financial Awakening

Welcome to my blog! I'm passionate about financial freedom and the transformative power of Bitcoin. Today, I want to share my personal journey with Bitcoin and how it has dramatically changed my life. My goal is to help you understand the potential of Bitcoin and inspire you to explore its benefits for yourself.

Early Financial Life

Before discovering Bitcoin, my financial life was a constant struggle. I lived paycheck to paycheck, barely managing to cover my expenses. Emergencies, like unexpected car repairs or medical bills, threw my finances into disarray. I felt trapped in a cycle of debt and financial stress, unable to break free.

Discovering Bitcoin

My journey with Bitcoin began when I stumbled upon an article about it online. Intrigued by the concept of a decentralized digital currency, I started to delve deeper into what Bitcoin was all about. The more I learned, the more fascinated I became. Bitcoin's potential to revolutionize the financial system and provide a hedge against inflation captivated me.

Learning About Money

One of the most profound impacts of my Bitcoin journey was the education it forced upon me regarding money. Before Bitcoin, I had a superficial understanding of how money worked. As I researched Bitcoin, I learned about the history of money, the mechanics of inflation, and the flaws in our current financial system. This newfound knowledge empowered me to make more informed financial decisions.

The Transformation

Bitcoin not only educated me about money but also transformed my financial habits and mindset. I began to prioritize saving and investing in Bitcoin instead of spending frivolously. Over time, I built a safety net that allowed me to handle emergencies without financial panic. My financial situation improved significantly, and I felt a sense of control and security that I had never experienced before.

Spreading the Knowledge

Inspired by my own transformation, I decided to create content to help others understand Bitcoin and achieve financial freedom. Through my YouTube channel and blog, I aim to demystify Bitcoin and provide practical advice on how to incorporate it into one's financial strategy. My goal is to empower you to take control of your finances and realize the potential of Bitcoin.

Practical Advice

Here are some practical steps for those looking to start their Bitcoin journey:

Educate Yourself: Take the time to learn about Bitcoin and the principles behind it. There are plenty of resources available online, including articles, videos, and podcasts.

Start Small: You don't need to invest a large amount of money to get started. Begin with small, manageable investments and gradually increase your exposure as you become more comfortable.

Secure Your Investments: Make sure to store your Bitcoin securely using reputable wallets and follow best practices to protect your assets.

Stay Informed: Keep up with the latest developments in the Bitcoin and cryptocurrency space to make informed decisions.

Conclusion

My journey with Bitcoin has been nothing short of transformative. It has empowered me to take control of my finances and dramatically improved my financial well-being. I encourage you to explore Bitcoin and educate yourself about money. The potential for financial freedom is within your reach, and I hope my story inspires you to take that first step.

Call to Action

I would love to hear your thoughts and experiences! Please share them in the comments below. If you found this post helpful, subscribe to my YouTube channel and follow my blog for more content on financial freedom and Bitcoin. Let's embark on this journey together and unlock the potential of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialFreedom#CryptoJourney#PersonalFinance#MoneyTransformation#DigitalCurrency#CryptoEducation#Investing#BitcoinStory#FinancialAwakening#CryptoLife#EconomicFreedom#BitcoinRevolution#CryptoCommunity#Blockchain#cryptocurrency#globaleconomy#unplugged financial#financial empowerment#financial experts#financial education#finance

12 notes

·

View notes

Text

The Emergence of NFTs: Transforming Digital Ownership and Creativity

Non-Fungible Tokens (NFTs) have revolutionized the way we think about digital ownership, art, and collectibles. By leveraging blockchain technology, NFTs provide a way to create, buy, sell, and own unique digital assets with verifiable provenance and scarcity. This article explores the world of NFTs, their impact on various industries, key benefits and challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of a specific item or piece of content, such as art, music, videos, virtual real estate, and more. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and unique. Each NFT is recorded on a blockchain, ensuring transparency, security, and verifiability of ownership.

The Rise of NFTs

NFTs gained mainstream attention in 2021 when digital artist Beeple sold an NFT artwork for $69 million at Christie's auction house. This landmark event highlighted the potential of NFTs to transform the art world by providing artists with new revenue streams and collectors with verifiable digital ownership.

Since then, NFTs have exploded in popularity, with various industries exploring their potential applications. From gaming and music to real estate and fashion, NFTs are creating new opportunities for creators, businesses, and investors.

Key Benefits of NFTs

Digital Ownership: NFTs provide a way to establish true digital ownership of assets. Each NFT is unique and can be traced back to its original creator, ensuring authenticity and provenance. This is particularly valuable in the art and collectibles market, where forgery and fraud are significant concerns.

Monetization for Creators: NFTs enable creators to monetize their digital content directly. Artists, musicians, and other content creators can sell their work as NFTs, earning revenue without relying on intermediaries. Additionally, smart contracts can be programmed to provide creators with royalties each time their NFT is resold, ensuring ongoing income.

Interoperability: NFTs can be used across different platforms and ecosystems, allowing for interoperability in the digital world. For example, NFTs representing in-game items can be traded or used across multiple games and virtual worlds, enhancing their utility and value.

Scarcity and Collectibility: NFTs introduce scarcity into the digital realm by creating limited editions or one-of-a-kind items. This scarcity drives the collectibility of NFTs, similar to physical collectibles like rare coins or trading cards.

Challenges Facing NFTs

Environmental Impact: The creation and trading of NFTs, especially on energy-intensive blockchains like Ethereum, have raised concerns about their environmental impact. Efforts are being made to develop more sustainable blockchain solutions, such as Ethereum's transition to a proof-of-stake consensus mechanism.

Market Volatility: The NFT market is highly speculative and can be volatile. Prices for NFTs can fluctuate significantly based on trends, demand, and market sentiment. This volatility poses risks for both creators and investors.

Intellectual Property Issues: NFTs can raise complex intellectual property issues, particularly when it comes to verifying the rightful owner or creator of the digital content. Ensuring that NFTs are legally compliant and respect intellectual property rights is crucial.

Access and Inclusivity: The high costs associated with minting and purchasing NFTs can limit accessibility for some creators and collectors. Reducing these barriers is essential for fostering a more inclusive NFT ecosystem.

Notable NFT Projects

CryptoPunks: CryptoPunks are one of the earliest and most iconic NFT projects. Created by Larva Labs, CryptoPunks are 10,000 unique 24x24 pixel art characters that have become highly sought-after collectibles.

Bored Ape Yacht Club: Bored Ape Yacht Club (BAYC) is a popular NFT collection featuring 10,000 unique hand-drawn ape avatars. Owners of these NFTs gain access to exclusive events and benefits, creating a strong community around the project.

Decentraland: Decentraland is a virtual world where users can buy, sell, and develop virtual real estate as NFTs. This platform allows for the creation of virtual experiences, games, and social spaces, showcasing the potential of NFTs in the metaverse.

NBA Top Shot: NBA Top Shot is a platform that allows users to buy, sell, and trade officially licensed NBA collectible highlights. These video clips, known as "moments," are sold as NFTs and have become popular among sports fans and collectors.

Sexy Meme Coin (SXYM): Sexy Meme Coin integrates NFTs into its platform, offering a decentralized marketplace where users can buy, sell, and trade memes as NFTs. This unique approach combines humor and finance, adding a distinct flavor to the NFT landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of NFTs

The future of NFTs is bright, with continuous innovation and expanding use cases. As technology advances and more industries explore the potential of NFTs, we can expect to see new applications and opportunities emerge. From virtual fashion and digital identities to decentralized finance (DeFi) and beyond, NFTs are poised to reshape various aspects of our digital lives.

Efforts to address environmental concerns, improve accessibility, and ensure legal compliance will be crucial for the sustainable growth of the NFT ecosystem. Collaboration between creators, platforms, and regulators will help build a more robust and inclusive market.

Conclusion

NFTs have ushered in a new era of digital ownership, creativity, and innovation. By providing verifiable ownership and provenance, NFTs are transforming industries ranging from art and entertainment to gaming and virtual real estate. While challenges remain, the potential benefits of NFTs and their ability to empower creators and engage communities make them a significant force in the digital economy.

For those interested in the playful and innovative side of the NFT market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

253 notes

·

View notes

Text

since this seems to be my topic of obsession for today...

turns out Bluesky internally uses content-based addressing and IPFS. I don't have a lot of use for it since it's a Twitter clone, and I've never got on very well with Twitter. Bluesky hides most of that from the user - it looks just like any old web app backed by a central server. i need to look into this more, Bluesky is taking inspiration from IPFS but it's using its own protocol, and it is doing some good things. I think its protocols could be used for something more Tumblr-like.

there's a protocol called PubSub which sounds like it does a lot of what I want, or rather gives you the low-level framework to broadcast info across a decentralised network. you could build a social network on top of that. IPFS uses it as one way of handling mutable data, like 'my website just updated'.

there's an absolute plethora of ideas, protocols, and tools for decentralised file sharing, decentralised messaging, decentralised social networks. this broad idea space is very much the hot new thing at the moment. some of them seem like they're growing. a lot of them have glossy websites with animations and stock photos of smiling people. it's hard to know in advance what's worth paying attention to. the whole field is dense with acronyms and rather abstruse concepts. which unfortunately means the current audience tends to be limited to tech nerds (c'est moi) and crypto cultists (ce n'est pas moi. merde!).

Briar is a protocol I find personally very appealing. it's security-oriented, designed to be crazy resilient, creating a mesh network through whatever protocols are available. you use it for E2E-encrypted messaging, but also you can use it for threaded discussions and blogs. right now it's only available for phones but they're working on a desktop version. the primary use case seems to be like "you're at a protest and the gov shuts off the internet", but it would be a very sexy place to put your blog. that said, I expect it would not be very fast at all.

the major encryptable, decentralised Discord/IRC alternative is Matrix. I broadly like the look of it, but we have the same problem of inertia getting people to switch from Discord, and there's still some jank I encountered when I tried it.

there's a lot of cryptocurrency in this whole area. (not surprising since the underlying tech of crypto is also hash-based, and there's ideological overlap between crypto and torrent people, because 'decentralised').

notably, there's a companion project to IPFS, a complicated scheme called FileCoin which is designed to encourage people to host data for a certain period in return for FileCoin tokens. you get FileCoins for consistently holding onto the data, and you lose a stake of FileCoins if you delete it prematurely. these FileCoins can then be used mainly to pay other people to host data for you: you pay FileCoins to a host, and pay them again to fetch your data(!). or you can trade them for other cryptocurrencies.

I'll acknowledge it doesn't seem as intrinsically environmentally corrosive as proof-of-work crypto, or even as simply 'the rich get richer' as proof-of-stake crypto. it's not filling up HDDs with random crap either. though it does sound like it requires quite a bit of CPU work to be done in all the hashing for the 'sealing' process.

I'm still not entirely convinced of the benefit this scheme brings. crypto stuff has a tendency to go belly-up very abruptly when speculative bubbles pop, so I wouldn't be super excited to rely on FileCoin for archiving some valuable bit of data. of course any offsite backup carries risk, e.g. Dropbox could go bankrupt one day. but I'm way less convinced of the benefits of something like FileCoin than IPFS. I guess it remains to be seen if this takes off.

25 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

March 29, 2024

HEATHER COX RICHARDSON

MAR 30, 2024

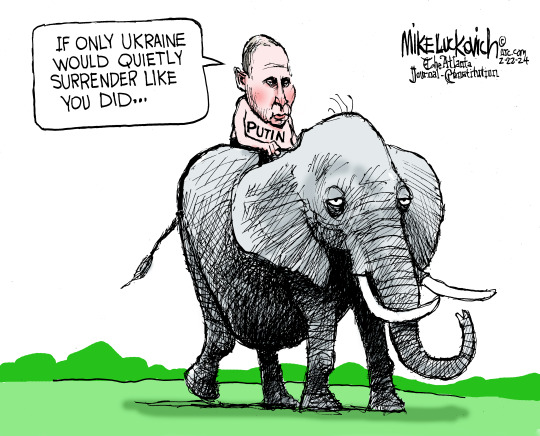

On Wednesday the nonprofit, nonpartisan Institute for the Study of War published a long essay explaining that Russia’s only strategy for success in Ukraine is to win the disinformation war in which it is engaged. While the piece by Nataliya Bugayova and Frederick W. Kagan, with Katryna Stepanenko, focused on Russia’s war against Ukraine, the point it makes about Russia’s information operation against Western countries applies more widely.

The authors note that the countries allied behind Ukraine dwarf Russia, with relative gross domestic products of $63 trillion and $1.9 trillion, respectively, while those countries allied with Russia are not mobilizing to help Russian president Vladimir Putin. Russia cannot defeat Ukraine or the West, they write, if the West mobilizes its resources.

This means that the strategy that matters most for the Kremlin is not the military strategy, but rather the spread of disinformation that causes the West to back away and allow Russia to win. That disinformation operation echoes the Russian practice of getting a population to believe in a false reality so that voters will cast their ballots for the party of oligarchs. In this case, in addition to seeding the idea that Ukraine cannot win and that the Russian invasion was justified, the Kremlin is exploiting divisions already roiling U.S. politics.

It is, for example, playing on the American opposition to sending our troops to fight “forever” wars, a dislike ingrained in the population since the Vietnam War. But the U.S. is not fighting in Ukraine. Ukrainians are asking only for money and matériel, and their war is not a proxy war—they are fighting for their own reasons—although their victory could well prevent U.S. engagement elsewhere in the future. The Kremlin is also playing on the idea that aid to Ukraine is too expensive as the U.S. faces large budget deficits, but the U.S. contribution to Ukraine’s war effort in 2023 was less than 0.5% of the defense budget.

Russian propaganda is also changing key Western concepts of war, suggesting, for example, that Ukrainian surrender will bring peace when, in fact, the end of fighting will simply take away Ukrainians’ ability to protect themselves against Russian violence. The authors note that Russia is using Americans’ regard for peace, life, American interests, freedom of debate, and responsible foreign relations against the U.S.

The authors’ argument parallels that of political observers in the U.S. and elsewhere: Russian actors have amplified the power of a relatively small, aggressive country by leveraging disinformation.

The European Union will hold parliamentary elections in June, and on Wednesday the Czech government sanctioned a news site called Voice of Europe, saying it was part of a pro-Russian propaganda operation. It also sanctioned the man running the site, Artyom Marchevsky, as well as Putin ally Viktor Medvedchuk, a Ukrainian oligarch, saying Medvedchuk was running a “Russian influence operation” through Voice of Europe.

The far right has been rising in Europe, and Nicholas Vinocur, Pieter Haeck, and Eddy Wax of Politico noted that “Voice of Europe’s YouTube page throws up a parade of EU lawmakers, many of them belonging to far-right, Euroskeptic parties, who line up to bash the Green Deal, predict the Union’s imminent collapse, or attack Ukraine.”

Belgian security services were in on the investigation, and on Thursday, Belgian prime minister Alexander De Croo added that Russian operatives had paid European Union lawmakers to parrot Russian propaganda. Intelligence sources told Czech media that Voice of Europe paid politicians from Belgium, France, Germany, Hungary, the Netherlands, and Poland to influence the upcoming E.U. elections. Germany’s Der Spiegel newspaper said the money was paid in cash or cryptocurrency.

Czech prime minister Petr Fiala wrote on social media: “We have uncovered a pro-Russian network that was developing an operation to spread Russian influence and undermine security across Europe.” "This shows how great the risk of foreign influence is," Dutch prime minister Mark Rutte told journalists. "It's a threat to our democracy, to our free elections, to our freedom of speech, to everything."

There are reasons to think the same disinformation process is underway in the United States. Not only do MAGA Republicans, including House speaker Mike Johnson (R-LA), parrot Russian talking points about Ukraine, but Russian disinformation has also been a key part of the House Republicans’ attempt to impeach President Joe Biden.

Republicans spent months touting Alexander Smirnov’s allegation that Biden had accepted foreign bribes, with Representative James Comer (R-KY) and Senator Chuck Grassley (R-IA) calling his evidence “verifiable” and “valuable.” In February the Department of Justice indicted Smirnov for creating a false record, days before revealing that he was in close contact with “Russian intelligence agencies” and was “actively peddling new lies that could impact U.S. elections.”

On March 19, former Rudy Giuliani associate Lev Parnas testified about the investigation into Biden’s alleged corruption before the House Oversight Committee at the request of the Democrats. Parnas was part of the attempt to create dirt on Biden before the 2020 election, and he explained how the process worked.

“The only information ever pushed about the Bidens and Ukraine has come from Russia and Russian agents,” Parnas said, and was part of “a much larger plan for Russia to crush Ukraine by infiltrating the United States.” Politicians and right-wing media figures, including then-representative Devin Nunes (R-CA), Senator Ron Johnson (R-WI), The Hill reporter John Solomon, Fox News Channel personality Sean Hannity, and other FNC hosts, knew the narrative was false, Parnas said, even as they echoed it. He suggested that they were permitting “Russia to use our government for malicious purposes, and to reward selfish people with ill-gotten gains.”

The attempt to create a false reality—whether by foreign operatives or homegrown ones—seems increasingly obvious in perceptions of the 2024 election. There has been much chatter, for example, about polls showing Trump ahead of Biden. But the 2022 polls were badly skewed rightward by partisan actors, and Democrat Marilyn Lands’s overwhelming victory over her Republican opponent in an Alabama House election this week suggests those errors have not yet been fully addressed.

Real measures of political enthusiasm appear to favor Biden and the Democrats. On Wednesday, Molly Cook Escobar, Albert Sun, and Shane Goldmacher of the New York Times reported that since leaving office, Trump has spent more than $100 million on legal fees alone. He is badly in need of money, and his reordering of the funding priorities of the Republican National Committee to put himself first means that the party is badly in need of money, too.

Donors’ awareness that their cash will go to Trump before funding other Republican candidates might well slow fundraising. Certainly, small-donor contributions to Trump have dropped off significantly: Brian Schwartz of CNBC reported last week that “[i]n 2023, Trump’s reelection campaign raised 62.5% less money from small-dollar donors than it did in 2019, the year before the last presidential election.”

Billionaires Liz and Dick Uihlein have recently said they will back Trump, and Alexandra Ulmer of Reuters reported on Tuesday that other billionaires had pooled the money to back Trump’s then–$454 million appeal bond before an appeals court reduced it. But Ulmer also noted that there might be a limit to such gifts, as they “could draw scrutiny from election regulators or federal prosecutors if the benefactors were to give Trump amounts exceeding campaign contribution limits. While the payment would not be a direct donation to Trump's campaign, federal laws broadly define political contributions as ‘anything of value’ provided to a campaign.”

Meanwhile, the fundraising of Biden and the Democrats is breaking records. Last night, in New York City, former presidents Bill Clinton and Barack Obama joined Biden onstage with television personality Stephen Colbert, along with event host Mindy Kaling and musical guests Queen Latifah, Lizzo, and Ben Platt. The 5,000-person event raised an eye-popping amount—more than $25 million—and the campaign noted that, unlike donations to Trump, every dollar raised would go to the campaign.

In his remarks, Biden said that the grassroots nature of the Democrats’ support showed in the number of people who have contributed so far to his campaign: 1.5 million in all, including 550,000 “brand-new contributors in the last couple of weeks.” Ninety-seven percent of the donations have been less than $200.

Tonight, Adrienne Watson, the spokesperson for the National Security Council, the president’s primary forum for national security and foreign policy, pointed to Russia’s devastating recent attacks on Ukraine’s energy grid and called again for Speaker Johnson to bring up the bipartisan national security supplemental bill providing aid to Ukraine that the Senate passed in February. She warned: “Ukraine’s need is urgent, and we cannot afford any further delays.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#War in Ukraine#Russian disinformation#Heather Cox Richardson#Letters From An American#Russia#Putin#Mike Luckovich#National Security#propaganda wars#Right Wing propaganda

12 notes

·

View notes